STRONG RESILIENCE AND REBOUND CAPACITY IN THE FACE OF THE CRISIS

NET CURRENT INCOME GROUP SHARE OF €415M

4th QUARTER RESULTS ABOVE 2019 AND ABOVE EXPECTATIONS, CONFIRM THE STRONG REBOUND THE 3rd QUARTER

FILING OF A TENDER OFFER ON SUEZ ON FEBRUARY 8th 2021 AT €18 PER SHARE DIVIDEND INCLUDED

-

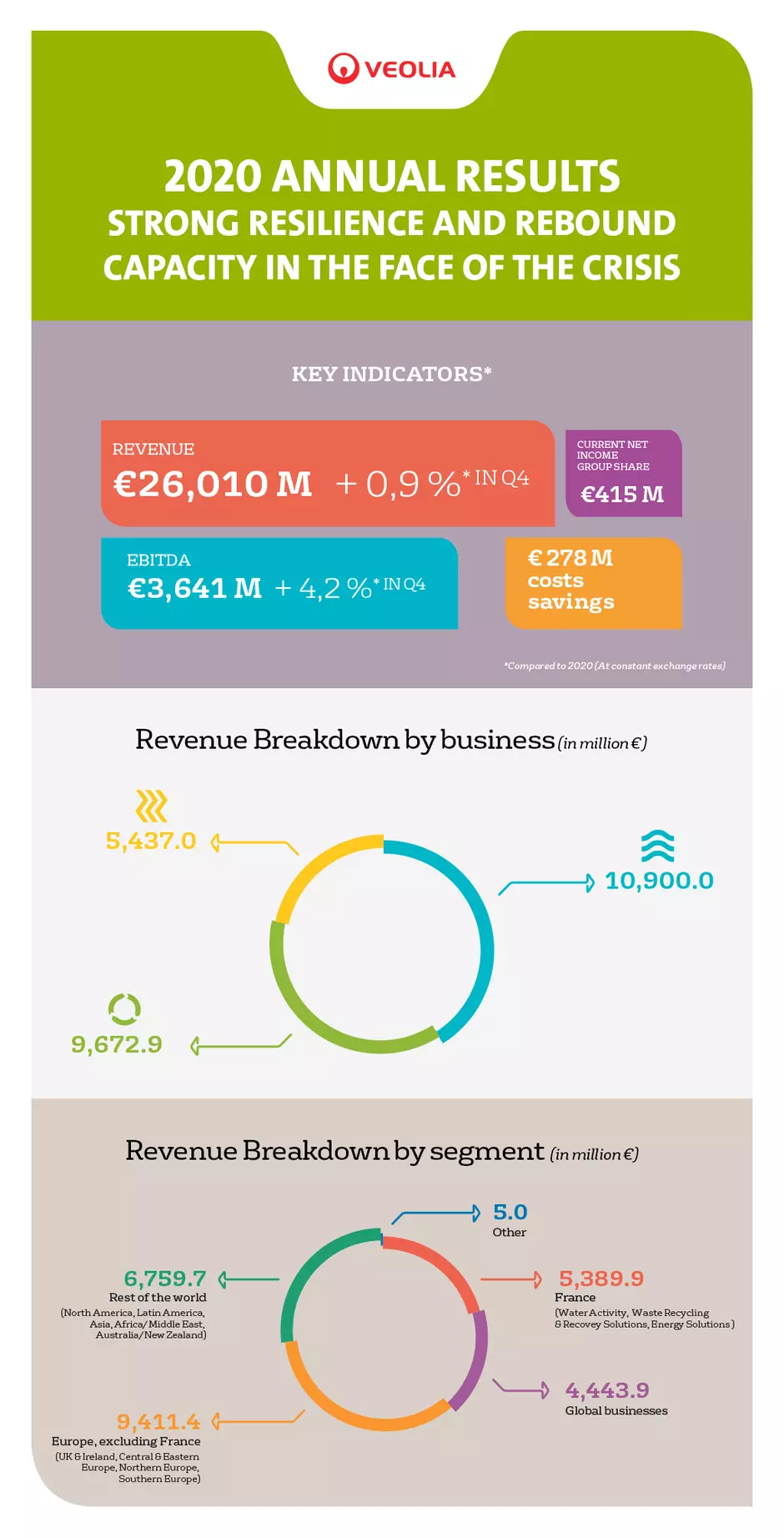

2020 REVENUE OF €26 010M

RETURN OF GROWTH IN Q4, TO +0.9%(1) -

2020 EBITDA OF €3641M, ABOVE THE GROUP’S REVISED TARGET, THANKS TO €278M IN EFFICIENCY GAINS, COMPLEMENTED BY THE RECOVER AND ADAPT PLAN

EBITDA UP +4.2%(1) IN Q4 -

NET CURRENT INCOME GROUP SHARE OF €415M

-

PROPOSAL TO INCREASE THE DIVIDEND FOR YEAR 2020 TO €0.70 PER SHARE

2021 PROSPECTS(2)

-

REVENUE ABOVE 2019 LEVEL THANKS TO SOLID ORGANIC GROWTH

-

EBITDA ABOVE €4BN

-

NET FINANCIAL DEBT BELOW €12BN AND LEVERAGE RATIO BELOW 3x

-

OBJECTIVE TO RECOVER THE PRE-CRISIS DIVIDEND POLICY AS SOON AS 2021

(1) At constant forex vs. 2019

(2) At constant forex

Antoine Frérot, Veolia’s Chairman & CEO commented: In 2020, Veolia has once again proven its remarkable capacity for resiliency in a significantly worsened economic context due to the unprecedented global sanitary crisis. The Group had already recovered its 2019 level of activity in the third quarter, a rebound which was amplified in the 4th quarter, with revenue growing and EBITDA up 4.2%. These very encouraging results have been achieved thanks to the outstanding commitment of all the employees of the Group, and thanks to the adaptation measures put in place at the very beginning of the sanitary crisis. Veolia will have thus wiped out all the impacts of the crisis and recovered its growth trajectory and its operating leverage in less than 6 months. In 2021, the Group should therefore achieve higher performance than in 2019. Moreover, in 2020, Veolia has seized the unique opportunity to create the world champion of ecological transformation by acquiring 29.9% of the capital of Suez. On February 8th 2021, we filed a public tender offer for the remaining 70.1% of Suez’s shares. Thanks to a unique complementarity, the new Group resulting from this industrial project will be ideally positioned to tackle the huge challenges our planet is facing, at a time when the environmental priority has never been stronger.